Would you be hard-pressed to come up with a $five invoice if requested at a register? As of 2017, approximately 1/2 of the population had moved to confined cash lifestyles, and five% wasn’t the usage of cash at all, in keeping with a U.S. Bank survey. Meanwhile, cell payments were rising dramatically, with 20.2% of the U.S. Population using the final yr. How, then, are we able to great recognize a way to manage our wealth without tangible each day evidence of the money going into — and coming out of — our coffers?

The solution lies inside the fundamental driving force of a cashless economy: era. Technology has freed society from wearing paper money and metal cash. Used correctly, it has the electricity to manual us to make higher economic decisions. Of path, the key’s to understand how first-class leverage tech to enhance cash literacy, red meat up credit scores, spend responsibly and facilitate long-time period savings practices. It all begins with attention.

Keep Reading: Experts Predict How Long Cash Will Survive

Finance Has Gone Virtual

The internet has been demonstrated to be an exquisite way of organizing and maximizing wealth. In truth, folks who are making the neatest money selections today are more often than no longer applying some online strategies to stay abreast in their income and money owed. They’re even using equipment consisting of the iPhone’s native Screen Time usage monitoring to use the ancient — but continually pertinent — precept, “Time is money.” If you’ve had hassle setting aside funds for destiny dreams, or maybe taking stock of your income and costs, consider those 5 tech-savvy money control alternatives:

1. Debt Management Apps Free You From Your Loans

Mint might be one of the maximum famous budgeting apps, so consider it a stepping stone to economic fulfillment. After gaining knowledge of the Mint ropes, search for apps just like the aptly named Debts Break, Debt Book, and Debt Tracker, which will let you pay down debt. Holding directly to a huge quantity of debt can not simplest hurt your price range. Still, it may additionally destroy your debt-to-profits ratio in the eyes of potential creditors.

These apps help spoil what can now and then seem like indistinct or far-flung goals into chunk-sized chunks. Also, personalized visuals help you watch your debt shrink, which facilitates your influence to pare down spending. The debt reduction manner can become so addictive that you may want to consolidate bills with the Trim app or use Credit Sesame to elevate your credit score rating. Every bit actually does help.

See: Drowning in Debt? 18 Effective Ways to Tackle Your Budget

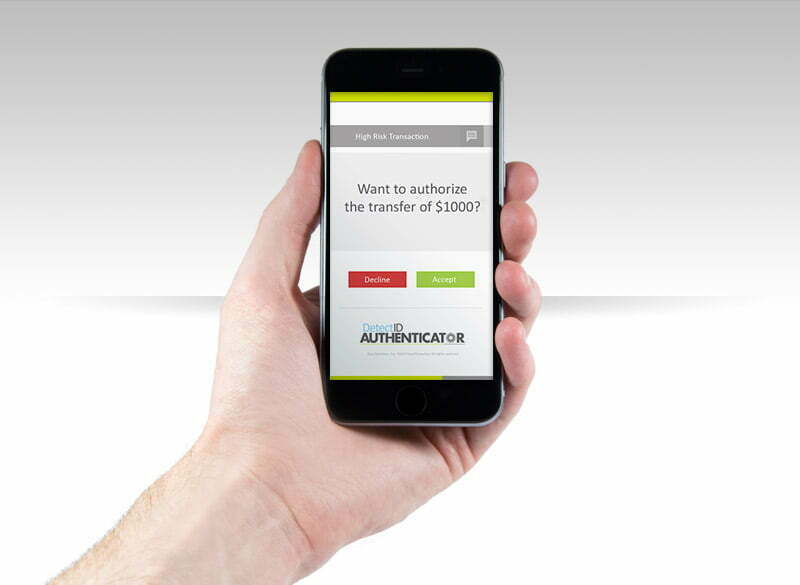

2. Digital Wallets Keep Your Money Secure

You can nonetheless maintain onto your wallet or purse for wearing debit and credit playing cards, no longer to mention your a lot-wanted ID. However, you would possibly find it less difficult to tune your spending with a virtual wallet. Digital wallets like Apple Pay and CrayPay offer a secure digital locale for all your cell payments. For instance, CrayPay eliminates all worries about identification robbery by eliminating identifiable elements of your payment techniques. Basically, while you pay through CrayPay, your information remains blanketed from nefarious eyes and functions. Besides, it’s less difficult and extra green to view all of your bills in a single vicinity. This will offer you a greater holistic view of your charges.

Cash vs. Credit Card: The Original Paper or Plastic Debate

3. Investment Apps Make the Stock Market Approachable

Do you feel like the inventory marketplace is set as approachable as an angry bull with an uncongenial cold? Turn lack of knowledge into a chunk of bliss via looking into investment-based apps on your Android or iOS telephone. Robinhood and Stash are two wonderful places to begin, as they each supply informative insights to enable you to and confidently grow your wealth with shares and bonds. Robinhood’s brokerage app is loose, whilst Stash requires an account minimal and a modest management fee. Still, this doesn’t suggest you have to avoid Stash, which can be the higher option if you’re critical approximately diving into the market or planning for retirement. Robinhood, then again, allows placed cryptocurrency investing at your fingertips.

Read More: 12 Best Apps for First-Time Investors

4. Money Apps for Partners Help You Combine Finances

Who says you need to take care of cash control on your own? You and your associate may additionally discover awesome alleviation and encouragement in combining your wealth and tracking it further. As you would possibly wager, there’s as a minimum one app for this. (Actually, there are plenty.) For starters, try Honey to get your household finances so as. The app even offers you the option to hold a number of your bills separately, which may be perfect, relying upon your monetary relationship and expectancies. Twine is another bicycle-built-for- non-public finance app with a focus on making your financial goals a reality, whether that means saving for your upcoming anniversary holiday or plotting a way to retire early. And if you sooner or later transition from couple to unmarried repute? Twine has you again via presenting recommendations and options for solo savers, too.

Related: 6 Ways Happy Couples Talk About Money

5. Gamified Savings Apps Save You From FOMO

Is the concern of missing out (FOMO) driving you crazy, even when it comes to coping with your money? Gamify your debt discount and wealth-building to rewire what you’ll find maximum rewarding. Gamified savings apps together with Status Money and the prize-linked Long Game use wholesome stages of peer stress and heavy doses of gamification to keep your attention on the quit result: turning into a first-rate saver. Rather than feel deprived via a lack of price range, you’ll get a feel of empowerment as you navigate virtual gaming tools to better your personal finance street cred.

You can also never emerge as a billionaire — or maybe you will. Regardless, you can balance your price range like an expert investor. All it takes is a little time and a nod to the era you’re holding for your hand. Keep studying for powerful ways to dig yourself out of debt.

More on Saving Money

Save More in 2019 With the Best Budgeting Apps. How to Pay Off Credit Card Debt. 12 Free Ways to Send Money to Family and Friends. 15 Best Mobile Banking Apps and Services Gabrielle Olya contributed to the reporting for this newsletter. This article originally regarded on GOBankingRates.Com: 5 Tech-Savvy Ways to Improve Your Personal Money Management