A small enterprise needs a mortgage unless it has high-quality sales and profit margins for a small enterprise to grow right into a massive business. A small commercial enterprise proprietor has quite a few places wherein he/she will be able to go with a mortgage request. Banks seem to be one of their alternatives on most occasions. What those proprietors may not comprehend is that banks have recently advanced popularity for rejecting small business loans. It appears that banks are more inquisitive about financing huge businesses because of their advantages. A financial institution can come up with a selection of motives to reject mortgage approval for a small enterprise. Some of the not unusual motives are as beneath:

Reasons for Banks to Reject Your Small Business Loan Credit History

One of the limitations between you and the business mortgage is credit score records. When you visit a financial institution, they observe your non-public as well as business credit score reviews. Some humans are below the influence that their personal credit does not affect their commercial enterprise loans. But it truly is no longer constantly the case. A majority of banks check out each of the styles of credit. One of the factors of credit that be counted a lot to the banks is credit score records. The length of your credit score history can affect your mortgage approval negatively or definitely.

The extra facts banks have to hand to assess your enterprise’s creditworthiness, the less difficult it’s fair for them to forward you the loan. However, if your enterprise is new and your credit history is brief, banks can be unwilling to ahead you with the preferred loan.

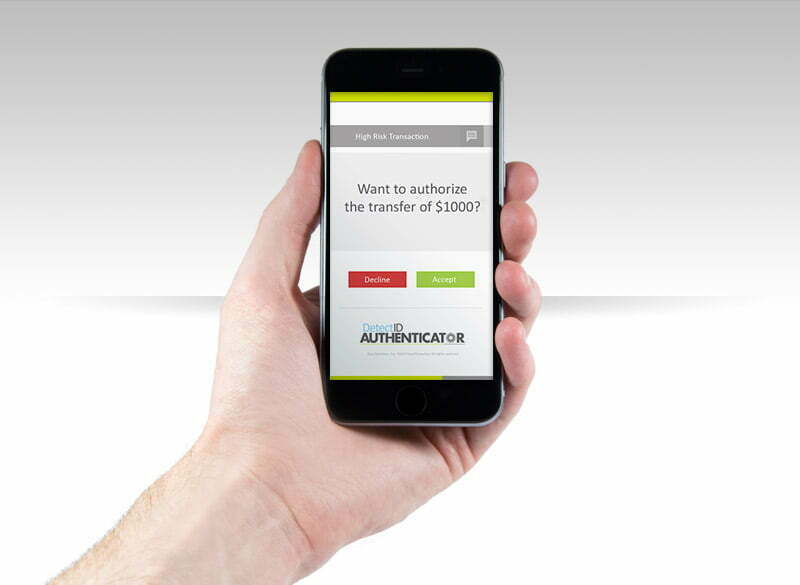

Risky Business

You must be aware of the term high-hazard business. In fact, lending institutions have created a whole industry for high-risk corporations to assist them with loans, credit card bills, etc. A bank can observe lots of factors to assess your enterprise as an excessive-risk business. Perhaps you belong to an enterprise that is excessive-threat in line with se. Examples of such companies are corporations selling marijuana-based total products, online playing structures and casinos, dating offerings, blockchain-based totally services, and so on. It is imperative to understand that your commercial enterprise’s sports also can make it a high-chance commercial enterprise.

For instance, your business may not be an excessive-chance business in line with se; however, perhaps you have got received too many rate-backs for your shipped orders out of your clients. In that case, the bank will see you as a volatile investment and might sooner or later reject your loan software.

Cash Flow

As said in advance, your credit history subjects plenty while a bank is to approve your mortgage request. While having a short credit score history will increase your possibilities of rejection, a long credit score history isn’t always a savior too. Any economic incidents to your credit records that don’t prefer your commercial enterprise can pressure the financial institution to reject your utility. One of the maximum vital issues is the cash waft of your enterprise. When you’ve got coins to go with the flow issues, you are vulnerable to receiving a “no” from the financial institution to your loan.

Your cash drift is a measure for the bank to recognize how you come to the loan without difficulty. If you are tight on cash drift, how can you manipulate the repayments? However, coins float is one of the controllable elements for you. Find approaches to grow your revenues and lower your expenses. Once you have the proper balance, you can method the financial institution for a mortgage.

The Debt

A mistake that small commercial enterprise owners frequently make is attempting out too many locations for loans. They will keep away from going to the bank first; however, they get loans from several different resources inside the intervening time. Once you’ve acquired your commercial enterprise investment from other sources, it makes sense to go back to it in time. Approaching the bank while you have already got a lot of debt to pay is not really useful in any respect. Do take into account that the debt you or your commercial enterprise owes influences your credit rating as well. In short, the bank does now not even have to investigate to recognize your debt. An assessment of your credit score document can inform the story.

The Preparation

Sometimes, your business is doing pleasant, and your credit score score is in proper form as properly. However, what’s lacking is a stable business plan and the right guidance for loan approval. If you have not already discovered it, banks require you to provide lots of files with your mortgage approval request. Here are only some of the documents you may gift to the financial institution to get approval for your loan.

- Income tax returns

- Existing loan documents

- Personal monetary documents

- Affiliations and ownership

- Business hire documents

- Financial statements of the enterprise

It would help if you were rather cautious while these documents and providing them to the bank. Any discrepancies can result in loan rejection.

Concentration of Customers

This one would possibly come as a wonder to a few, but several banks don’t forget this issue of your business seriously. You have not overlooked that loans are banks’ investments. Businesses that method the banks are their cars to multiply their cash within the shape of interest. If the bank senses that your commercial enterprise does not have the ability to extend, it may reject your loan request. Think of a mother and a keep in a small metropolis with a small population. If it handiest serves the humans of that town and has no potential to develop similarly, a rejection is coming near.

In this particular case, even if the commercial enterprise has significant income margins, it relies on its normal customers for that. However, the bank would possibly see it as a returnable mortgage now, not as an investment opportunity.